Stay in touch with the latest news from AIM and get information on sector grants, jobs and events with our free fortnightly E-News.

Energy Action Group – Energy price update

The surge in global gas prices is showing no signs of abating, “the first big energy shock of the green era” according to Australian consultancy EnergyQuest. We spoke to Geoff Berry of AIM’s Energy Action Group for the latest advice.

With the crisis continuing to hit UK businesses and homes there is much speculation as to how long market conditions will prevail, and what actions can be taken.

Russia’s controversial new Nordstream2 gas supply pipeline to Germany should provide some relief, and, in the UK, medium term winter weather forecasts predict above average temperatures, but there is less confidence over early 2022.

Whilst this is potentially good news, accelerating demand for gas in China, India and much of Southeast Asia, as well as the urgent necessity to refill depleted gas storage in Europe remains.

Energy prices may remain high: European power prices are forecast to hold near current record levels until 2023 based on capacity closures and strong gas and carbon prices, before new renewables capacity and falling gas prices have an impact, according to S&P Global Platts Analytics. In the UK, rising carbon prices and an increase in transmission charges will also add upward price pressure.

With little new gas/LNG supply coming in the near term and consumption about to rise sharply, gas prices are expected to remain at exceptionally high levels over winter. HSBC warns that energy costs are unlikely to return to normal for two years.

What can you do to mitigate cost rises?

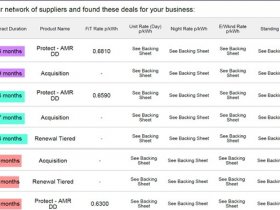

It comes down to your attitude to risk: if you are approaching your gas or electricity contract renewal within the next six months you are in the challenging position of having to choose to accept exceptionally high short-term 12 month prices in the hope that those will drop in 12 months’ time. Or you could select a longer term contract with lower rates, but at the risk prices will drop significantly in 12 months’ time and you will be locked into a higher rate. The examples (click image) below are based on the same single supply and provide 12, 24 and 36 month prices. In all instances the longer term contracts offer lower prices than short term, a reversal of normal pricing models.

So which term should you select? You could risk accepting the short-term contract in the hope that prices will drop, but the evidence for that happening is not convincing. EAG’s advice would be to choose the longer term rates as they provide budget certainty as you grapple with increasing costs. (Be sure that any offer you select is both a ‘fully-fixed’ price and for a fixed-term). EAG’s pricing model bears out analyst forecasts of slowly softening prices as we approach 2023. The shorter the contract term the higher the prices.

Other actions to consider

Manage consumption – we can’t emphasise enough that the best way to start combating rising energy prices is to reduce your consumption. You can achieve this through ‘Monitoring and Targeting’ and the first target is to eliminate energy waste. EAG offers a comprehensive Energy Management platform that provides clarity on how and when you use energy.

Generate your own electricity – generating your own electricity is the best way to reduce costs. You may think your building is unsuitable, but you may find you have other options available.

Energy Action Group contacts

The AIM Energy Action Group offers UK museums and heritage attractions the opportunity to best manage energy costs and gain energy advice.

For more information visit the AIM EAG pages>> or contact the EAG on

01256 976808